When you see cheerleaders and puppeteers working hard to persuade the public that we are just going to a small short time glitch, you better know that things are very serious. And if the 30+ million unemployed have not convinced you of that yet we can take a look at some of the sale numbers.

Now as you know American love, I mean love their cars. In the United states there is about 275 million vehicles registered. Considering that we have less than 210 million people between 15 and 64, that is more the one vehicle for all driving adults. Now let us take a look at the sales of vehicles in 2019.

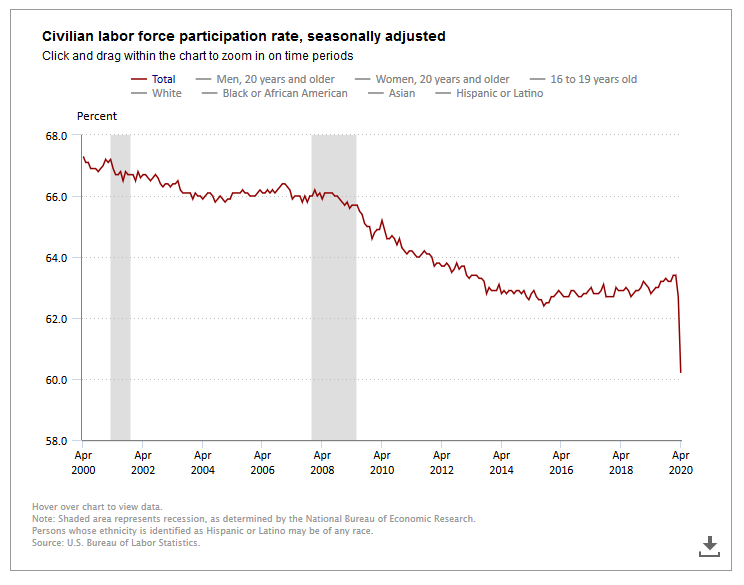

Notice how fast the dip happened and compare that to the dip of 2008 for example. If each working individual has a car and the vast majority of them bought the car based on “how much do you want spend a month” deal, then that means the “deal” is overpriced and financed based on the contingency of monthly payment. When the job is gone, the payment is gone and so is the car. To get the big picture let us look at the labor participation rate since 2000.

Source: https://www.bls.gov/charts/employment-situation/civilian-labor-force-participation-rate.htm

Does that look like a recovery to you! Further, since we are talking about cars, let us look at car registrations in the United States. Look at the numbers since the early 80s.

And again, it is not hard to understand the big picture that is consistent with the “average Joe” economics. Take a look at this depiction of the real wages in the US.

Source: https://bongino.com/have-wages-stagnated-since-1970/

So really the car registration number has been telling us what the story was, but for most people they would rather live in denial. And for a lot of people it is much easier to to hang their hope on this or that “messiah” that is going to save them or fight for them.

But the moral of the story is, there has to be bunch of cars coming back to dealerships. And if the supply and demand principle holds, there has to be a substantial reduction in prices to get these car off the books again. For now, people might be holding on to that they have due to the subsidies they received from the “government”. And as long as there is that hope of more money, why not. But, as soon as reality hits and people realize that this is not going to be solved by $1200, or $2400, the choice will be shifted. People will start dumping their possessions (cars then houses) and rather than paying their obligations, they will pocket the money for the fresh start.

https://fred.stlouisfed.org/series/TOTALSA

https://fred.stlouisfed.org/series/MVLOAS

https://fred.stlouisfed.org/categories/32440

According to JP Morgan: “On November 09, our tracker of Chase consumer card spending fell from -6.7% to -7.4%. The tracker fell -3.9%-pt over the prior week, and it is 33.5%-pt above its low of -40.9% on March 30.”

Source: https://markets.jpmorgan.com/research/open/latest/publication/9002054

This might signal the “street” feelings about the second wave. The signals coming out from officials in regard to “voluntarily lock down”, partial closures, school suspension indicate that they know, this might run out of hand quickly.

Update on the Civilian labor force participation rate.

https://www.bls.gov/charts/employment-situation/civilian-labor-force-participation-rate.htm

Alhambra investment insight

https://www.youtube.com/watch?v=yxBs199CBvc

FRB/US

https://www.federalreserve.gov/econres/us-models-about.htm

Jolts

https://www.bls.gov/jlt/