This is the ticker for Marriott. I wanted to take a look at this stock and was really surprised with what I found.

The first thing I did, I went to listen to the last presentation/conference. Nothing scary but nothing encouraging.

Second, in the call I heard that they authorized 3 Billion dollars “cash back” to investors through dividends and buybacks. And just to make sure, buybacks means the insiders are about to sell their stocks.

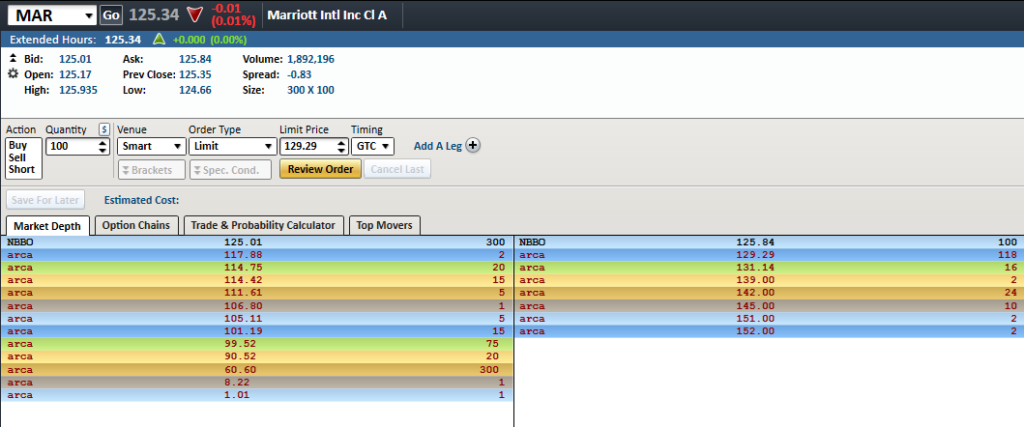

If you take a look at the stats of Marriott from Yahoo, the stock is trading at $125.34 today close. The dividend is $1.78 and they have 285 million stocks float, these are what is available to trading. Simple math then show us that the dividend paid is going to be 507 million. So the rest of the 3 billion, 2.5 billion to be specific is going to be buybacks. Based on $125 stock price that is about 20 million shares. That is taking out about 7% of the stocks. Also i you look at the daily volume, which is 1.6 million (number of stocks traded daily), that is 12.5 day’s worth. So they can suck almost 13 full days of trading.

Then you look at the volume daily, granted this is after hour but look how thin this damn thing is.

I wanted to take a look to see if I am correct about the insiders getting out, and what do you know:

NASDAQ filling, stock is being sold down to $128.

And you can find out the company fillings with EDGAR here, and here is the link (https://marriott.gcs-web.com/financial-information/sec-filings) from Marriott direct.

I still think the stock is has to fall but I am worried that it might turn out to be another Zillow, where they pump it up for another 6 or 12 months to try to squeeze the shorts.

The market is up today about .07% on the S&P and the stock is up 1%. It is still at $125 and change. Watching the market depth though is like watching something in slow motion.