This is almost the oldest question known to man kind, after the story of Adam and the apple. The answer is like everything else in life, it depends. But everytime I talked to a home owner they acted like you are crazy if you do not own a house. I am not saying you are not, but it is not the only option and maybe not the most beneficial option too.

Let me share with you the following two scenarios. Scenario one: you buy a 1/2 a million dollar house and you pay it off in the typical 30 years period. Scenario two, you decide to rent rather than buy and effectively reducing your monthly payment. But you take the difference and you invest it for 30 years. How do both options compare? Nothing more convincing than numbers, so let us look at some. Let me share tow plots with you. I am going to summarize the assumptions I used in each calculation.

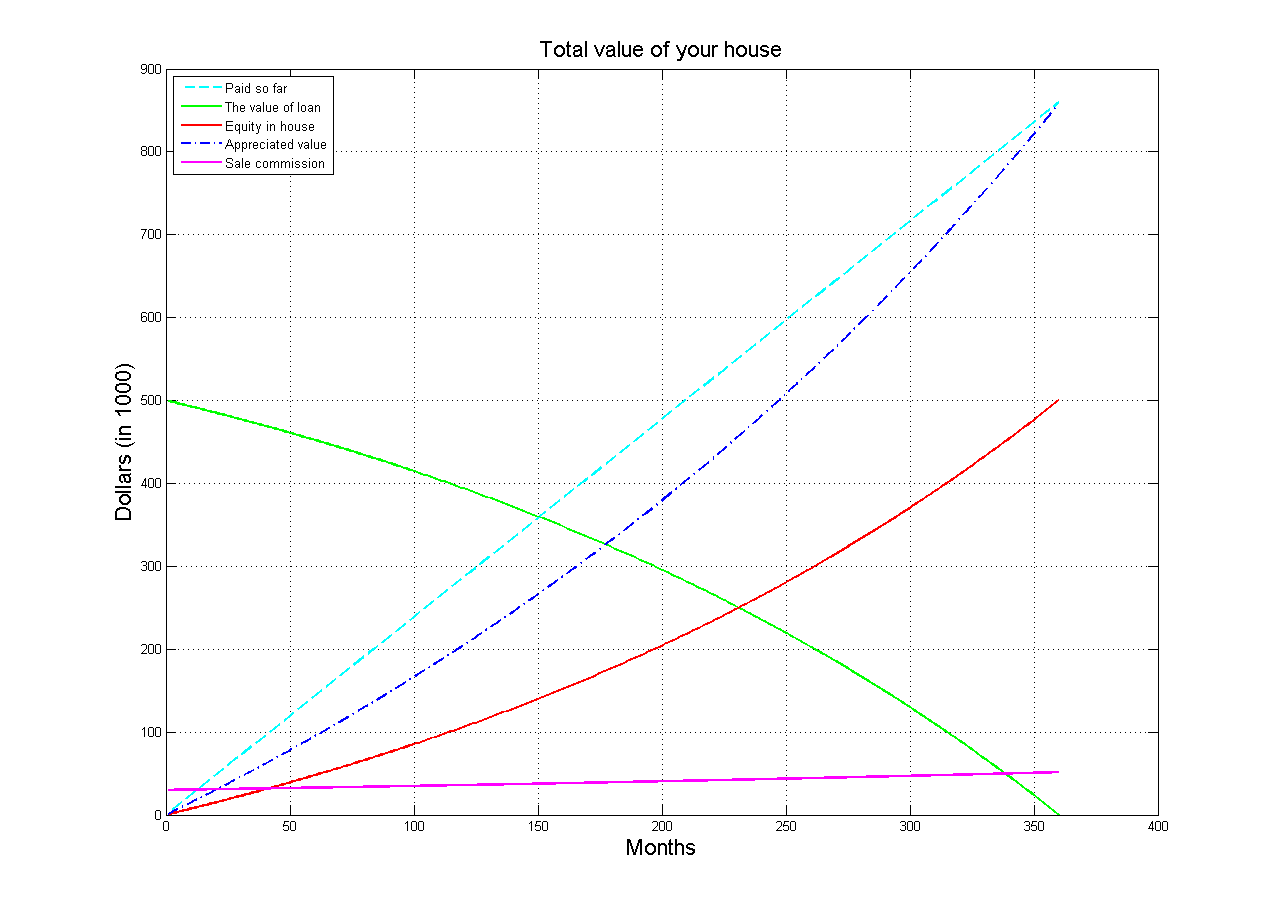

Scenario one: You buy a 1/2 a million dollar house with zero down payment at 4% annual rate. I assumed a 1.8% appreciation rate. If you take a look at the graph, you will realize that this was done intentionally to make the expenditure line (Cyan dashed) and the value of the house (dashed-dotted blue line) after appreciation meet after 30 years. That tells you that if you want to recover what you have paid, you need to get a minimum of 1.8 appreciation a year.

After 30 years you end up with 850k of equity under the above assumptions. The Blue dark dashed-dotted line is your equity growing monthly. The Cyan dashed line is the money coming out of your pocket on monthly basis. The green solid line going done is what you owe the bank on monthly basis. It goes to zero at the end of 30 years.

I ignored all taxes and all side expenses associated with owning a house. That means that your expenditure are about 5-8k more each year. This means that the expenditure line above is less than what it is in reality. Considering that taxes are about 2-4%, you can see that now you need about 3.8-4.8% appreciation to recover all that you spent. Usually home appreciations is about inflation which has been running around 2-3%.

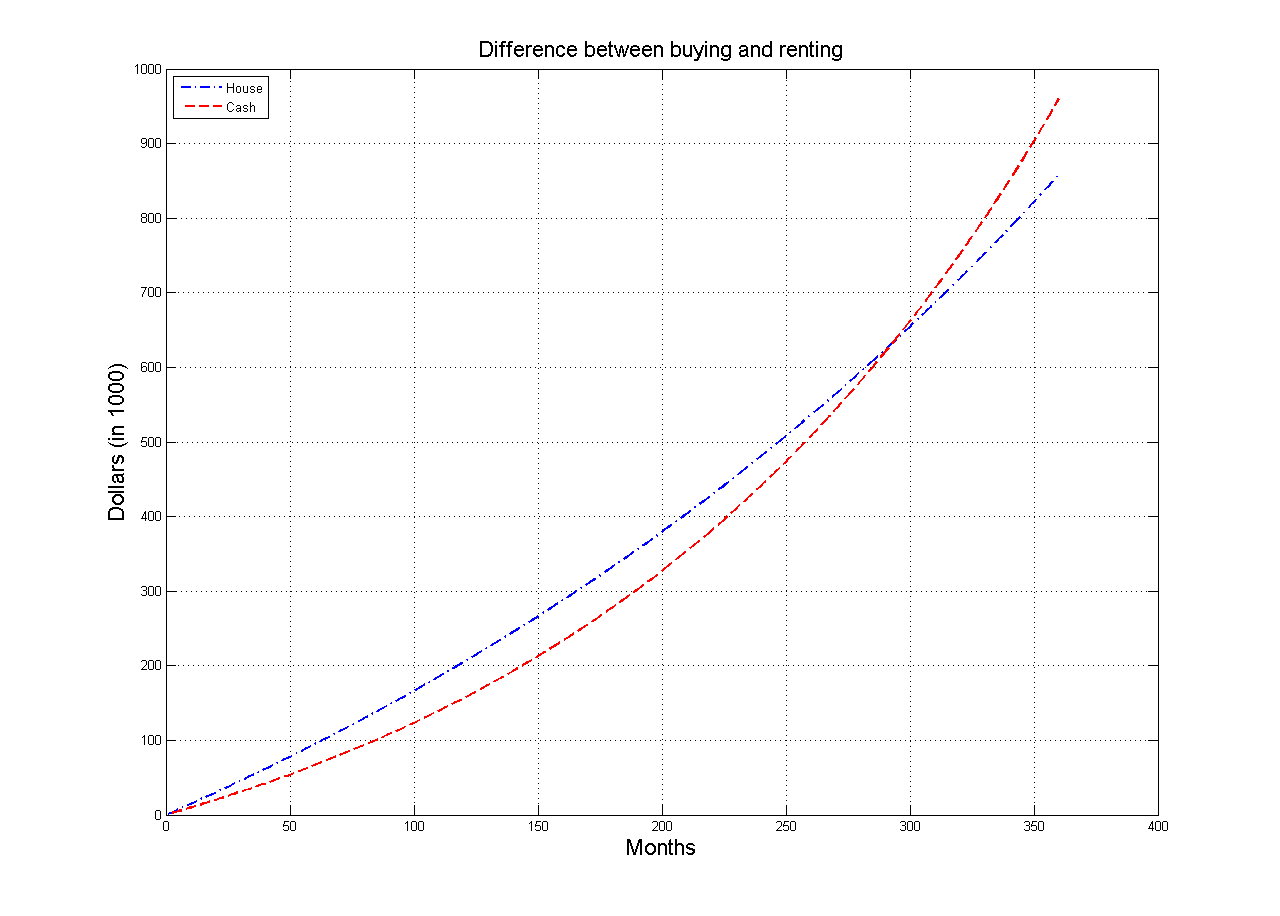

In scenario two I am assuming that you have zero cash to start with. Only this time you rented instead for buying. I am assuming that your rent is 60% of your house monthly payment. Which means every month you have 40% of your house payment to play with. Now you are going to take this money and invest it at 6% (which what AT&T and Verizon are paying today) every month.

The red dashed line is how much money you grow in 30 years and the blue dasedh-dotted line is the equity of your house, as in the first graph. As you see the two lines are not too far from each other and in year 24, your cash investment starts to exceed the equity of your house. Note here that I did not consider any intrinsic appreciation to your financial investments. Say you bought AT&T or Verizon. They pay 6% but the price of the share also goes up with time. This increase was not considered.

This is by no means a very rigorous calculations but very close. The process is not really that complicated. The key here is being able to reduce your rent to mortgage ratio. If you can stay close to the numbers above, then you will end up making the same amount of money and having never owned a house. I am not trying to discourage you from buying a house; I personally think it is a good hedge against inflation. But I am trying to show you, that if you do not, you can still make money, if not more money. Things are changing and you ought to understand your options.

How an obsession with home ownership can ruin the economy | The Economist

Here is an example from a different country but the same idea, Why aren’t millennials buying homes?