I find that figuring out how things work is probably the most interesting things of life. And every time something seems “mysterious”, it turned out that one can explain it with a bit more learning and effort.

The stock market has alluded the professionals and there is no shortage of super smart people working on modeling what makes it work. But from my perspective, the simplest approach is the best approach. It might not be the most accurate but in most cases you can capture 90% of the phenomenon by just simple logical analysis.

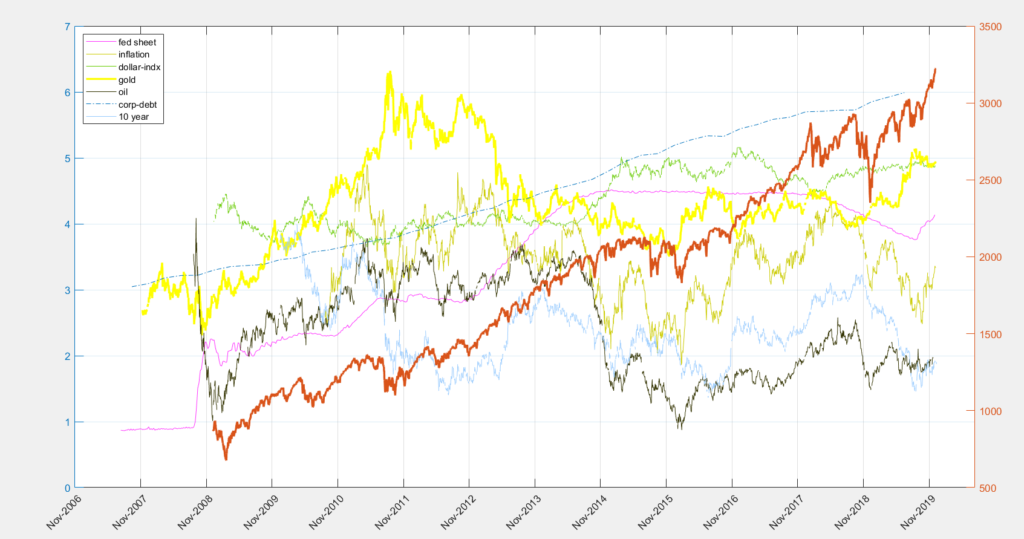

As I am driven crazy with the market moves, particularly the last couple of month, and tired of the talking heads trying to “train the public” on how to act and react based on these “messages” they send them, from technical analysis to “news”, I wanted to take a very wide angle look at the market behavior. I went back and plotted the S&P (the right axis to scale – thick red line) and for the same time period (since the 2009 crisis till now) I plotted, the size of the fed sheet (including REPO recently), inflation, dollar index, gold, oil, corporate debt and 10 year interest rate. These are all on a scaled left Y-axis. The actual values do not really matter but rather the behavior. It is clear that there are intermittent correlations among these parameters and with the S&P. But the one thing that is clear and has went up and up hand and hand with the S&P is corporate debt.

Any student of economics will tell you that if we were in such a great economy, we would be paying off debt not generating debt. However, if the debt was associated with CapEx then it would be a good debt. But everyone knows that CapEx has been basically nonexistent and the only investment corporate America is doing is building its supply chains in China and other overseas places. Just take a look at what is happening now to Boeing (and do not forget the F-35 that cost 35 times what it was supposed to) and see where Huawie is accomplishing around the world.

Also, one take debt when they are strap for cash, but we all know that corporations had so much cash on record than they did not know what to do with. They even got a huge tax break to bring their cash to the US because they were going to invest it here, bullshit. So, the only reason they will take more debt is if they know that they are not going to have to pay it back.

Sooner or later they will come again asking the “government”, the same “monster” and “boogie man” they tell the tax payer they do not want in “our businesses” for a bail out. And tax payer will (well we know has no say), yes will “have to do it” for the country. But this time there is no place to hide and shift the risk to but in the gradual dissolution of the US dollar value. They will not let “to big to fail” fail and they will not raise interest rate. Every one is in it to win it for themselves.

Few people are calling it the way it is now, here is one that actually made it to a main stream media.

Peter Toogood, and he very well might be :). strategist says markets have nothing to do with fundamentals anymore.