A big deal is made about the yield curve inversion (what is the yield curve inversion) and bunch of variations of it, such as 10-years to 2-years. And it is always presented as an “indicator” for a coming recession. But reality it is really a results of interest rate cycle (source).

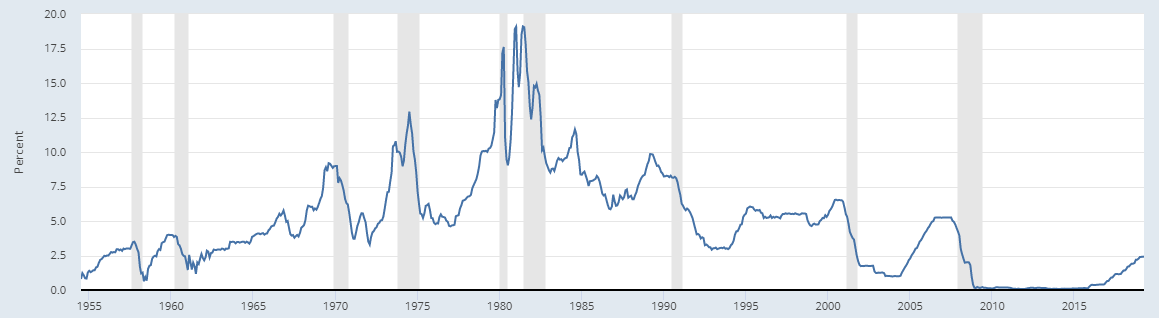

As the figure above show, the inversion itself is cause by a hiking of the interest rate that cause the short end of the curve faster than the long end and that cause inversion, so far so good. Let us take a look at the interest rates as taken from FRED.

One thing I want to point out about the above chart. Note how the interest rate though each recession kept dropping till we passed the recession period. But not notice what happened in 2008 crash. We simply did not have “enough rate” to do so. I.e. we got to zero interest before we got out of the recession. We just had no place to go. That is why I believe the recession(s) have not really ended just got a face lift. The nation economy has been on life support of some kind since 1980.

Not only that but since 1980 the interest rate has been establishing lower peaks and lower bottoms. For example look at the interest rate right before the 2000 recession. As soon as the interest rate got up to the previous bottom , around 1993) the recession was on the horizon. Take a look at the crash of 2008. As soon as the interest rate hit 5 or 5.25, the previous low, the recession was on the horizon. Now we are at 2.5 which is higher than the 1.00-1.25 we were at before the last hiking period, and therefore it is reasonable to see that a recession is coming in the next few months.

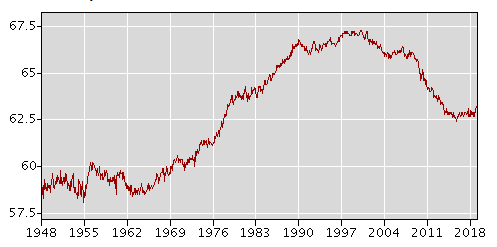

If we look at the labor participation rate taken from the BLS. We can see that the “economy” has not recovered really. Unlike what you hear about the greatest economy ever, the labor participation rate has been on the decline since 1997. Now, maybe more people absolute number are working today but remember that the population of the use grew by 60 million people since 1997. But percentage wise we have 5% less people working today than we had in 1997.

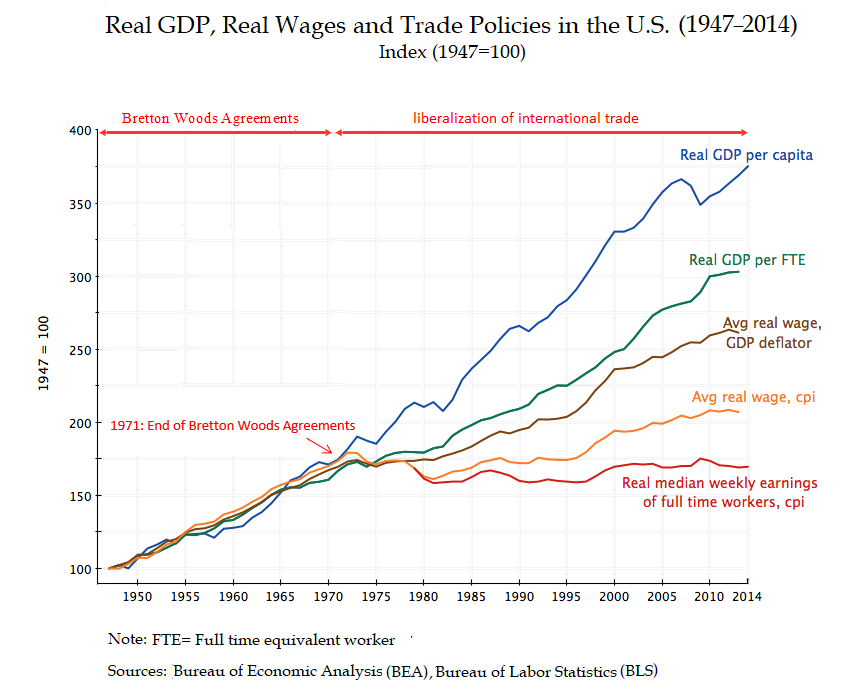

This is not a coincidence. Globalization started in the 70s post the Nixon trip to China. And look what start to happen from the 70s. Effective wages have been pretty much flat since then as shown below (source) And that should not surprise anyone. Jobs were sent overseas and more cheap labor was being imported to the country putting huge pressure on workers and their wages. So where exactly is the “economy” has been improving? The stock market perhaps but not the economy.

What is strange though is that according the the government CPI, there has been very limited inflation since 2000 (source ). Yet according to the “same government” housing prices literally double from 2000 till 2018 (source). The same thing is true for the Case-Shiller house index. Other sources () present the same statistics but with inflation adjust numbers and the story seems to be a little different, but the idea is the same. However, these adjustments are another prof of inflation.

The loan industry requirement for a loan is 30-40% of house hold income. Meaning, for the average American family 30-40% of their income goes to housing. And if that 30-40% increase by 35% since 2012 alone would not that mean a total of 10% inflation due to house prices alone? Yet the FEDs want to tell you that they do not see inflation. I would like to know where they shop of groceries, clothes, cars, etc. Maybe they have a discount store the rest of America does not know about!!

The moral of the story, when inflation (or asset prices) run out of hand, the feds jump in. They have effectively one thing, interest rate and liquidity and one impact the other. I.e. sucking liquidity from the markets will lead to rising interest rate and rising interest rate leads to less liquidity. When they raise the interest rate, the curve gets inverted before the recession. It does not mean that the inversion is causing the recession, but rather what they are seeing on the horizon that caused them to raise interest rate does.

Only this time they are stuck and there is not place to go. They will go to zero interest rate, they will pump money in the system. Bundle that with the demographics and the baby boomer existing the housing market and job market. The latter two will add sever pressure on housing prices and social security. Eventually this will lead to higher taxes, on the little guy of course and less cash in hands. The FEDs will have to react to prevent a total collapse and they will print more money. We are potentially looking at a scenario similar to that of Venezuela.

One final thought on the job market. No matter what you are going to hear, these jobs are never coming back. But as soon as automation becomes cheaper than a Chinese or Vietnamese you will be hearing companies talking about coming back to America and reviving the American economy. The “plantation” has not changes much. People do not learn and they are putting each outer out of business. The final domestic example, UBER and LYFT. Think how many taxi drivers they put out of business. They are loosing money the their own workers in addition to the “investors” are subsidizing the loss. That is just like when companies come to a new state or city and ask for “incentives” the latter are usually in billions of dollars so they can create 10-20 minimal wage jobs. And as soon as the automation comes, all the current UBER and LYFT drivers will be left with the meter running but no cash flow.